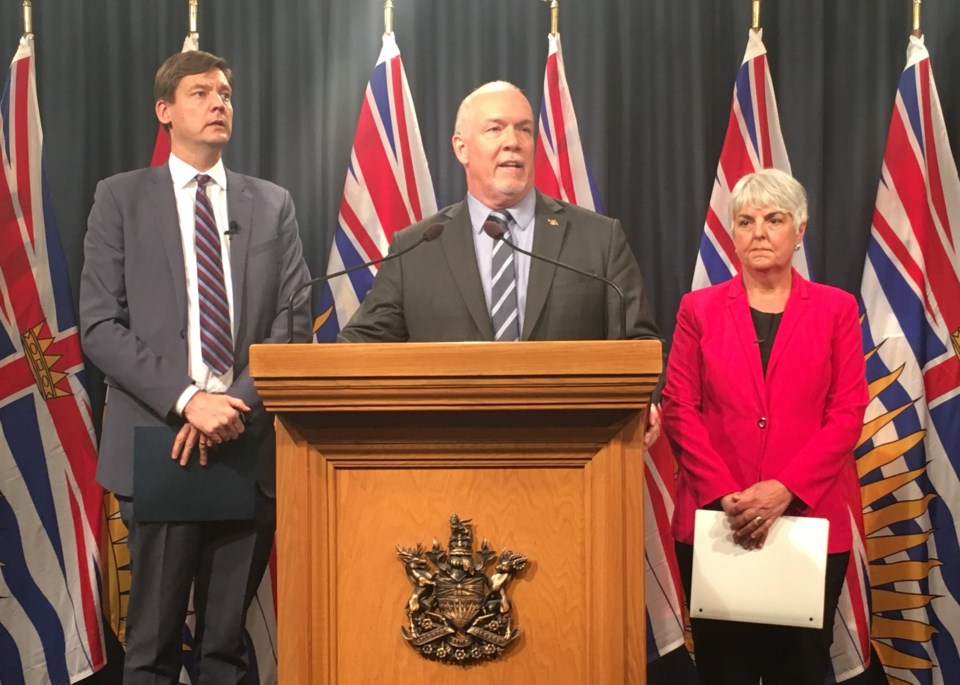

The effect of money laundering on Lower Mainland real estate prices has been all over the news, with multiple expert reports, endless media buzz, and the NDP’s launch of a public inquiry.

The claims from the experts, media and NDP politicians seem to be treated as gospel. The Maloney Report, commissioned by the NDP Government, claims money laundering inflated B.C. housing prices by “3.7 to 7.5 per cent.”

The NDP, meanwhile, put out a government press release pegging money laundering as the cause of a 20 per cent price boost in the Lower Mainland. Bloomberg News pushed back on that number, noting the panel’s own chair said it was impossible to calculate such localized effects.

Of course, as the Financial Post noted, the Maloney report doesn’t offer a single scrap of evidence or even an anecdote on laundering through real estate, but it does trot out an “economic model” to try and estimate it.

I’m not arguing there isn’t some money laundering in the B.C. economy; indeed, there is likely some in every developed economy in the free world. And perhaps the incredibly-expensive public inquiry will sort it all out – or not, as Black Press prophesies.

But let’s take a step back for a moment. Let’s just accept the Maloney Report’s estimate of a 5 per cent price boost due to money laundering. Sounds bad, doesn’t it? That’s $50,000 on a million dollar home! Or $20,000 on a $400,000 condo! But in the grand scheme of real estate prices, there are a number of factors that have driven up the price of housing by far more than 5 per cent. Think about it:

1. The Agricultural Land Reserve. Restricting the supply of developable land is a major factor in property price. With one-fifth of the Lower Mainland deemed off limits to housing, it drives up costs. If $6.3 billion in money laundering (out of $100 billion worth of residential sales) jumped costs 5 per cent, how much more does forbidding development on 21 per cent of the land supply do to land prices?

I’d love to quote a study for you on this effect, but the government doesn’t want to do one on the ALR’s impact on housing costs; they know it would open up a very awkward conversation on land use and the value of agriculture in the Lower Mainland.

2. The Property Transfer Tax. Created in the late 1980s by Premier Bill Vander Zalm to (wait for it!) curb foreign investment in the Lower Mainland housing market, this tax has morphed into quite the revenue beast for government. Today, PTT is charged on the following scale:

- 1% on the first $200,000;

- 2% from $200,001 to $2,000,000;

- 3% from $2,000,001 to $3,000,000; and

- 5% on anything over $3,000,001 (and this doesn't even include the infamous-but-Dave Eby-adored “School Tax”, which comes on top of annual property taxes on homes assessed at this level).

“Ha!” you may cry out. “No normal human is buying a home worth $3 million plus! Only nefarious money launderers and shell corporations!” But PTT is charged every time property changes hands, which can be three or four times during the process from greenfield to condo building. This means the tax is embedded into the price over and over again – driving up the price far more than the estimate on money laundering – even on regular person homes.

3. GST. If money laundering is driving up housing prices by 5 per cent, it precisely matches the effect of the GST. Yet we don’t see any criticism of the GST and its effect on new home prices.

4. Taxes in general. Three years ago, while I worked with the Canadian Taxpayers Federation, we released a report outlining the 107 taxes, fees, levies and charges that the City of Vancouver imposed on new homes. We found it drove up the cost of a new condo by 37 per cent – SEVEN TIMES THE ESTIMATE ON MONEY LAUNDERING. Sorry to yell in ALL CAPS but it’s a stunning number. (And it’s more today.)

There are other factors driving up housing costs, of course. More expensive materials, shortage of workers driving up labour costs, immigration, demographic shifts, and the rest.

None of these other factors get the kind of scrutiny of money laundering. I get it; gangsters are a sexy, interesting thing for journalists to report on. Gangster stories generate award buzz and online clicks. And David Eby doesn’t leak or hold news conferences on government policies driving up costs.

Faceless, foreign bad guys make welcome scapegoats on talk radio. But I can’t help but feel we are letting our elected officials off the hook for how they’ve been inflating property prices all these years.

Jordan Bateman has a long history of public policy work, championing small business and fiscal responsibility. Currently the Vice President, Communications & Marketing for the Independent Contractors and Business Association (ICBA), Jordan also served six years as the B.C. Director of the Canadian Taxpayers Federation, and was a two-term Langley Township Councillor.