Buy or sell? As a tumultuous year for the B.C. housing market draws to a close, a common question facing owners, renters and investors is whether 2020 will be a good time to call the real estate agent? The answer however may be more about where than when.

“The first half of 2019 was extraordinarily weak in almost every market, but since about late spring, markets have rebounded,” reports Brendon Ogmundson, chief economist of the B.C. Real Estate Association (BCREA).

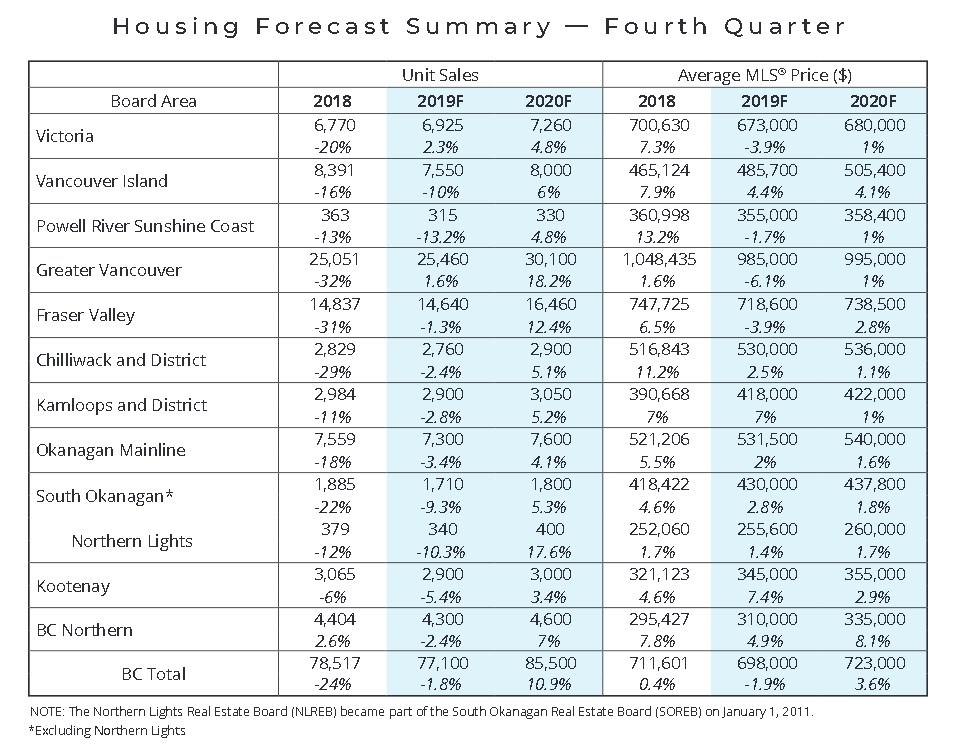

While final BC-wide sales figures for 2019 have yet to be tabulated, the Multiple Listing Service (MLS) recently predicted a sales decline of 1.8 per cent to about 77,100 units this year, after recording 78,505 residential closings in 2018.

Ogmundson credits the recent buying trend to lower mortgage rates which he contends have helped offset the effects of the so called “stress test” that the federal government introduced last year as a result of concerns related to an overheated and unsustainable housing market.

With the BCREA suggesting that sales activity in most markets has returned to a “long run” average, Ogmudson is quick to point out that “normal” won’t be returning to the heady days of buyers competing for properties, willing to pay well over asking price.

“It’s certainly not going to be the way it was,” says Ogmundson, noting market conditions are far different than before 2018.

“There are a number of factors that are going to hold back demand a bit,” he says, referring to stricter mortgage qualifying guidelines and evidence of a slowing economy, such as last month’s loss of over 18,000 BC jobs.

While residential sales are forecast to increase 10.9 per cent to 85,500 units in 2020, Ogmudson notes that some markets are feeling more upward pressure on prices, mostly due to supply issues. The BCREA is forecasting that markets such as Kelowna, Kamloops, the Kootenays, and parts of Vancouver Island can expect price increases of 5 to 7 per cent in 2020.

Nowhere in B.C., however, has the cost of housing soared like Kitimat, where a massive LNG project is being developed. With relatively low sales and little supply, the average cost of home in Kitimat ballooned 60% in 2019 – and further substantial gains are expected in 2020.

“The dampening effects of federal mortgage rules mean that rather than a return to the heights of recent years, home sales are simply returning to trend after sustaining a significant shock,” says Ogmundson.

As demand normalizes, the accumulation of resale inventory has reversed course in many markets around B.C. In his latest housing forecast, Ogmundson anticipates that this trend will continue in 2020, with sales and listings finding balance.

By region, the BCREA crystal ball forecasts the following for 2020:

Asked whether housing is a good investment in British Columbia, Ogmundson doesn’t mince words, noting several disincentives including a rental cap and new taxes:

“There are a lot of policy directives and other issues in real estate currently making housing less attractive for investors.”

As always, I welcome your comments and criticism on Twitter @kammornanchor and email [email protected].

Bob Price is a veteran B.C. broadcaster who anchored the morning news on CHNL radio in Kamloops for the past 30 years. Bob is also a past Webster Award winner whose previous stops included Vancouver and Calgary.

SWIM ON:

- Last week, Bob Price shared Interior mayors' respective wish lists for Santa.

- Bob looked back at 2018.

- Last October, Bob considered the housing market and wondered how hot is too hot?