Earlier this week, the Business Council of British Columbia issued a quiet brief about the trends emerging in BC’s economy. The title – Creaky Ships Navigate Choppy Waters – was foreboding.

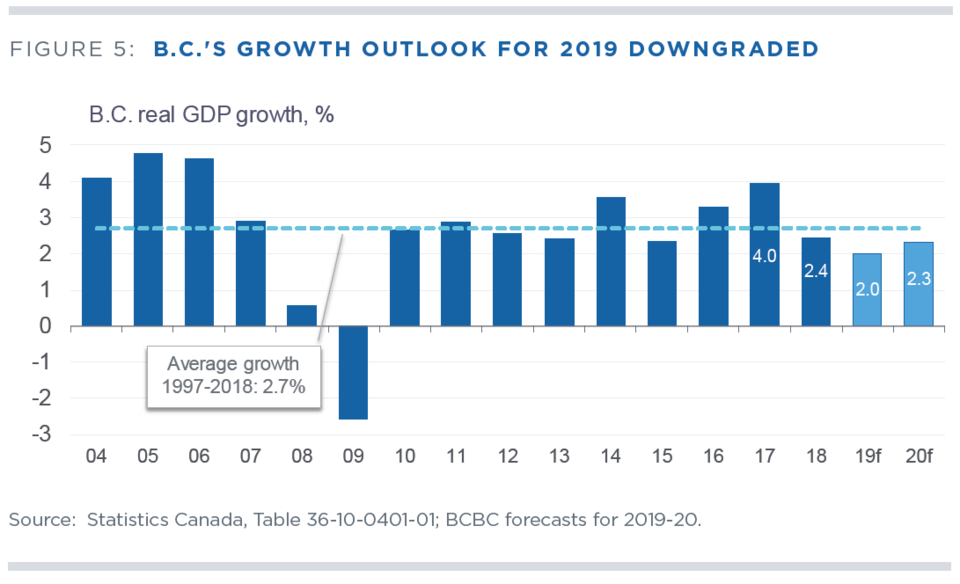

The big news: BCBC is downgrading its forecast for B.C.’s economic growth from 2.2% to 2%, which could have serious ramifications for provincial government revenues. Coincidentally, on the very same day, Finance Minister Carole James discussed the government’s public accounts, touting a $1.5 billion surplus.

Who’s right here? Is this even contradictory? To find out, Maclean Kay called Ken Peacock, chief economist of the BCBC, and one of the two authors of the report.

"We are definitely seeing a trend towards slower growth."

Maclean Kay: Can you tell me a bit about the forecast, the overall themes and what you found?

Ken Peacock: We're taking a look around the global economy and seeing some slowdown there and some weakness in the US economy. Then of course, that extends to Canada as well. Our economic performance has been downgraded recently.

The external backdrop for the provincial economy points towards some softening. We are starting to see signs of that in BC's export sector – but there's some evidence things are also slowing on the domestic side as well. So we have downgraded our forecast to 2%.

At the start of the year, we were thinking that growth would be around 2.2%. This follows 2018, which also saw a significant slowdown from the previous year.

So we are definitely seeing a trend towards slower growth.

Maclean Kay: To many people, a downgraded forecast from 2.2 to 2% might not sound like a big deal. Can you explain a bit what a 0.2% downgrade means?

Ken Peacock: The average person on the street may not be able to feel it, but it’s significant because we're talking the provincial and national economy.

Two-tenths of a percentage is a significant portion of an overall potential growth rate of 2%. The other thing to keep in mind when you're thinking about these growth rates is they compound over time. So if you can get an additional two-tenths or three-tenths of a percentage point in growth and sustain that for four or five or six years, that cumulatively has a significant impact.

It also has a meaningful impact on government revenues. A slowdown of say, three-tenths of a percentage point will affect the amount of tax revenue generated.

"If things continue...I think the government could have some challenges balancing the budget."

Maclean Kay: You mentioned government revenues. In her budget, Finance Minister Carole James had forecasted 2.4% growth and obviously made her plans around that. How much of an impact on provincial government revenues would a reduction in economic growth to 2% mean?

Ken Peacock: Yeah, that's going to be a meaningful difference in provincial coffers. My suspicion is that the surplus originally envisioned when the Finance Minister brought her budget down in February is probably largely gone – and so I suspect they're operating on probably very thin margins right now.

If things continue to moderate in the way they have, in the manner they have, I think the government could have some challenges balancing the budget. I say that just because you just look at some of the revenue items – start with housing. Property transfer tax is going to be way down because resale housing, resales are off so sharply. They're down significantly. That's a big hit to the government revenue.

Next look at retail spending, because retail sales tax is a substantial source of revenue for the government, and retail sales year over year are essentially flat.

Even a couple of years ago, retail sales grew as much as 10% year over year. Now? Down to essentially zero. So [the government] is not getting any lift from provincial sales tax, I would suspect.

They probably will still do fairly well from income tax revenue because the job market's been strong and there tends to be a bit of a lag with that. But again, we'll probably see some softening, if not this year, then next. So, I think it's going to be a challenge for the government to balance its budget. As I said, I suspect they have chewed up any potential surplus that they envisioned earlier.

Maclean Kay: Earlier you mentioned some bright spots.

Ken Peacock: The job market remains robust. Non-residential construction is very strong, that stands out as a bright side. Technology exports, some service exports, film and television are still quite robust.

Employment remains strong. Public sector employment's up a bit, but mostly driven by private sector employment growth. So that's a bright spot.

Now there are a few caveats there. Looking at some of the regional data, you're starting to see employment soften up in the Caribou, and started to slow down in the North Coast – and that’s with LNG construction underway. In other more resource- dependent parts of the province, the employment picture is starting to change. For the time being, I would say BC still has a strong job market, but some cracks are starting to show.

Interestingly, tourism has been a very significant bright spot over the past few years – but we’re starting to see some signs of that softening as well. The number of tourists flowing into BC has leveled off over the past six to eight months. So soft spots abound, but there are a couple of bright spots in the BC economy.

"I would [tell the NDP] 'proceed cautiously.'"

Maclean Kay: For the NDP government, there are still big-ticket items on the horizon, things like public sector contracts. Given your forecast, what advice would you give the Finance Minister?

Ken Peacock: I would say, "proceed cautiously."

I think the risks to the outlook are more on the downside than on the upside, because of the trade turmoil and the general trend is slowing.

The whole resale housing industry was an economic engine and economic driver, and we've taken that out of the economy. It's going to be difficult to get growth much above 2%. I would prepare for a slower, softer growth over the next two years – and with downside risks.

From everything I've seen, I'm sure the [NDP government] is well aware, and I'm sure they're struggling and grappling with exactly how to manage this slower revenue growth going forward.

Maclean Kay is Editor-in-Chief of The Orca