Last week the BC Utilities Commission (BCUC) published their report on the Inquiry into Gasoline and Diesel Prices in British Columbia. I want to identify some features that affect gasoline prices the report did not effectively address – and explain why their omission potentially invalidates some of the Inquiry’s conclusions.

Valuing Compliance with Regulations

The government’s Terms of Reference for the BCUC Inquiry made it virtually impossible to get a fair answer to questions about gasoline prices. The Terms of Reference said:

The commission may not inquire into the effects of Provincial enactments on gasoline and diesel prices in British Columbia

The term “enactments” was carefully chosen. It prevented the BCUC from looking both at gasoline taxes and regulatory requirements like our Renewable & Low Carbon Fuel Requirements Regulation that many observers don’t even know exist.

In their analysis, the BCUC had one of their consultants (Deetken, in this report) estimate a potential cost for meeting BC’s Renewable and Low Carbon Fuel Standard (LCFS). Deetken chose to rely on a regulatory instrument called a compliance credit (called a “Compliance Unit” in the report).

Compliance units are like carbon offsets: a limited number are issued, which operators can buy or sell as they transition their facilities to meet regulatory requirements. But the BCUC was not allowed to ask oil companies directly about their costs to meet the LCFS – so this cost could not be verified.

There’s a problem with relying on Compliance Units. Like any restricted product, they often start out cheap, but the price will increase over time. Reasonable operators will invest in addressing the regulatory requirements as soon as they can, rather than relying on units that will likely cost more in the future.

Consequently, the BCUC can’t assume that operators aren’t making large one-time investments now that won’t be repeated. The value used in the report might represent the operator’s maximum costs, or might be completely out to lunch. There’s no way to tell, since the report didn’t ask operators what they’re spending to meet the regulatory enactment.

As such, the 4 cents per litre number used by the BCUC in their report may be wrong.

The search for the elusive “marginal barrel”

As I discussed in my previous article on gasoline prices; the critical consideration in establishing the price of gasoline in BC is identifying the “marginal source of supply”.

The BCUC struggled mightily to discover this elusive unit. They lacked the regulatory authority to request answers from suppliers in Washington State. To try and fill the gap, they used the Pacific Northwest (PNW) spot price as a proxy. They justify using this proxy here:

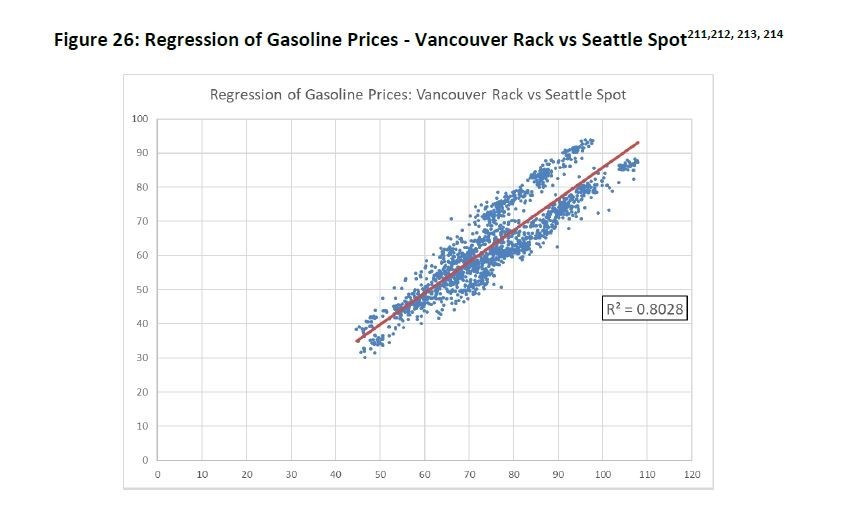

The four companies participating in the Inquiry generally agree that the PNW spot price is the primary driver of the rack price for Vancouver and southern British Columbia. The graph below shows that 80 percent of the variation in the Vancouver gasoline rack prices can be explained by the PNW spot prices as reported by OPIS:

If you’re not familiar with an R-Squared value; it’s supposed to tell you the percentage of the response of a variable explained by a linear model.

But there’s a problem. Like any simple statistical method, it can often give a result that doesn’t reflect the true situation. This is clearly the case in Figure 26 above.

Deetken argues the bifurcated dataset above represents a single population – but anyone with eyes can see we have two different overlapping populations that would have two different fit lines. Because the approximate number of points in the upper and lower lines is the same, the graph generated an anomalously high R-Squared value; in other words, they got a larger value than they should have.

This is why we don’t rely blindly on statistical tests. It’s clear this is a statistical anomaly.

Something far more complicated is happening in this graph. Certainly, the PNW spot price is an important variable – but it appears to be affecting the two populations to a different degree. The high R-Squared value is an artifact and the assumption that the PNW spot price controls 80% of the variation is likely wrong as well.

How property taxes can affect retail margins

The most baffling omission in the BCUC report was not evaluating the effect of property taxes on retail margins. From page 101 of the report:

Generally speaking, there was support among the marketer retailer group with respect to Deetken’s characterization of land value being an explanation for the largest part of the difference in retail margins. However, none went so far as to try to explain how the actual retail price at any point in time is directly impacted by the value of the land where a particular service station was located.

It is possible the authors assume that changes in the mill rate will negate land value increases for retail outlets; they would be wrong. Recent changes to how BC Assessment values properties have hit retail operators particularly hard.

In BC, properties aren’t taxed solely on existing buildings. Rather, BC Assessment also considers what could potentially exist, or the property's “highest and best use”. A gas station in Vancouver doesn’t just pay taxes on the land under it, but also on the value of the air above.

In other words, a service station will be taxed as though it were a multi-story mixed commercial and residential tower.

Consider a (real) gas station on the corner of Burrard and Pantages in Vancouver. According to Vanmap, its 2019 assessment was $52,693,000. That value comes with a massive tax bill. In Vancouver, a gas station in 2019 will pay a business tax rate of $9.32931 per $1000 taxable value. On the 2019 assessment that translates to $491,589 per annum in property taxes.

That’s $1,346.8 per day, every day, in property taxes.

Granted, that facility is an extreme example. So look at the station at 1743 Burrard Street. Worth $22,485,000, it would have a tax bill over $200,000 per year. It’s hard to find a gas station in Vancouver or Burnaby that hasn’t faced a massive property tax increase in the last five years.

The Deetken report appears to try to address this, comparing the rise in property values to similar rises in places like Toronto. But they ignore one crucial factor: in many Lower Mainland communities, taxes on commercial properties are substantially higher than those for residential properties.

In 2018, the commercial-to-residential ratio (CRR ratio) was 4.398 in Vancouver. That means for a property with the same land value, a business owner would pay 4.398 times more than a residential owner. Deetken completely missed the differential burden placed on retailers here when compared to other western jurisdictions.

Specifically, Deetken compares Vancouver (with a CTR ratio of 4.398) to Regina (1.722), Calgary (3.056) and Edmonton (2.443). Vancouver’s ratio is almost double.

An increase in property values in Vancouver has over twice the effect on property taxes than a similar land value increase in Edmonton. This means the reliance solely on land value by Deetken (and BCUC) completely underrepresents the resultant change in property taxes – and thus overhead costs – on the retailer.

What does this mean? The report’s calculation of the effect of land value increase on retail margin – and thus gas prices – would be similarly off.

Conclusion

The BCUC report talks about the unexplained 13 cents per litre difference between the PNW spot price and the average Vancouver gasoline price. The BC price was based on an analysis that relied on prices at 10 am each day. As Parkland points out, retail prices are highest in the morning and drop at night. So, the basic number used by the BCUC in their analysis is likely skewed high – before any other analysis even begins.

Regardless of whether the Vancouver price is biased high, the unexplained 13 cents per litre can mostly be explained by things the BCUC was NOT allowed to investigate.

The BCUC was not allowed to look at taxes and enactments. It had no power to compel Washington suppliers to reveal their elusive price for the “marginal source of supply.” Most importantly, the entirety of that unexplained 13 cents per litre might possibly be explained by evaluating the true cost of land value increases (and resultant increases in property taxes) on retail operators.

It was simply impossible for the BCUC, under its terms of reference to come up with a reasonable answer to the question of what drives our gasoline prices.

Blair King is an environmental scientist who works out of Langley BC and blogs at the website A Chemist in Langley on the topic of evidence-based environmental decision-making.

SWIM ON:

- Blair King previously wrote about factors driving up (see what we did there) the price of gas in the Lower Mainland.

- Jordan Bateman did the math on gas prices, and turned that into free advice for opposition parties in BC.

- #BCPOLI Hotstove discussed gas prices (and various and sundry other topics, as is their wont) back in April.